The end of FiT: Challenges of Solar PV Energy in the Japanese Market and the rise of FiP

The Japanese government seriously considered the role of renewable energy in its energy mix after the disruptive 2011 Great Tohoku Earthquake (3/11), massive tsunami, and ensuing Fukushima nuclear disaster which shook to the core its long-standing pro-nuclear energy policy. It proposed an energy transition backed by the Feed-in-Tariff (FiT) system as one of the main drivers of its new vision. When the original FiT program was launched in July 2012, the renewable generation capacity in Japan was around 20 gigawatts. The program has been an overwhelming success largely driven by solar PV, leaping the national total capacity generation to more than 81 gigawatts by 2021.

However, despite the existence of the energy policy and normative framework that backed the rapid expansion of renewable forms of energy, very particularly Solar Energy, In June 2021, the Japanese government announced it would begin the transition to a Feed-in-Premium (FiP) starting from early 2022, due largely to the mounting pressures to the budget that was caused by falling renewable costs and sharp increase in new entrants to the FiT scheme.

In this article we take a snap look and commentary to the current state of the Solar Energy Market, looking at the after-effects of the roll out of the Feed-in-Premium (FiP) scheme.

The End of FiT and the Transition to FiP

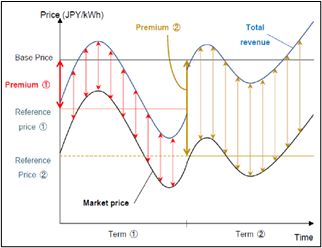

When the Japanese government announced it would begin the transition from a Feed-in-Tariff (FiT) to a Feed-in-Premium (FiP) starting in April 2022, after having for several years gradually reduced FiT rates for new entrants, there was poor understanding of how the FiP scheme would function, particularly the impact on revenue projections, that have enjoyed great predictability under the FiT scheme. The FiP scheme functions by allowing a certain premium to be added to the market price, instead of purchasing electricity at a fixed price as under the FiT. With that, renewable energy power producers have an incentive to act based on market supply and demand conditions. More than two years after the introduction of the system, here we present the current outlook looking at generation and project roll-out.

According to Shulman Advisory, from the latest information provided by METI as of the end of February 2024 FiP system (including both new certifications and projects shifting from FiT certifications to FiP certifications that include all Renewable Energy classes) was approximately 1507MW across 1036 projects. Out of the total generation, Solar Power accounted for 518MW across 955 projects. In relation to project scale, the utilization of the FIP system is looping ahead in low-voltage solar power projects for business use with less than 50kW.

Despite the initial largely documented setbacks FiP scheme faced, particularly associated with the level of uncertainty power producers faced given that under the FiP scheme, the revenue fluctuates along with the market price and unlike the FiT Scheme, now utility companies are no longer required to purchase the output of renewable energy generators, the current comprehensive growth is welcome news as it fosters competition between developers and incentivize innovation among generators while reducing the burden of consumer costs. Additionally, a second order effect was the ability of energy generators to increase the supply of electricity during peak hours, using Battery Energy Storage System (BESS) systems to maximize revenue, thus addressing one of the core risks initially faced, related to the relative reliability of prediction and maximization of revenue.

Supply Promotion Subsidy of FiP (Hamada and Mori 2020)

Solar Panel Photo Source: Vector Renewables Japan

By Mauro Ricardo Simão on Behalf of the TA Team Japan

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.